SNAPSHOT - TAX TABLES (KEY DATES AND RATES)

Key dates - Self Assessment Calendar

Main dates of the self assessment calendar: 6 April to 5 April

6 April

Tax Returns sent out by HMRC

Tax payers who need to fill in an annual Tax Return

1 May

Daily Penalty of £10, up to a maximum of £900

Taxpayers who have failed to complete their prior year Tax Return

31 July

Second payment on account due for current period

Those taxpayers who make regular half-yearly payments on account

1 August

First tax geared penalty levied for failing to submit a prior year Tax Return before this date

Taxpayers who have not yet completed and sent back their prior year Tax Return

3 August

Further 5% late payment penalty on tax still outstanding for prior year

Late payers of tax still due for prior year

31 October

Filing deadline for completing and returning paper Tax Returns

Taxpayers who want HMRC to: calculate their tax for current period; and collect tax owing for current period of less than £3,000 through their code number in following period

31 December

Non-mandatory filing deadline for 2019/20 online Tax Returns

Online filers who want HMRC to collect tax owing for current year of less than £3,000 through their code number in following year

31 January

Filing deadline for current year online Tax Returns. Payment date for the balance of tax due for current year and the first payment on account for following year

Taxpayers sent a current year Tax Return. Taxpayers who need to settle either of these liabilities

1 February

First penalty notices issued for the late filing of a current year Tax Return

Taxpayers who were sent a current year Tax Return.

3 March

First 5% late payment penalty imposed for failing to pay tax due by 31 January and still outstanding on 3 March

Late payers of tax for current year

National Insurance Contributions - Class 1 Contribution for employees

Rates of National Insurance Contributions for 2019/20

Contributions levied on all weekly earnings above £162 but that do not exce

Standard Rate 12%

Contracted out 10.6%

Earnings threshold

Weekly £166

Monthly £719

Annual £8,632

Upper earnings limit

Weekly £962

Monthly £4,167

Annual £50,000

Contributions levied on weekly earnings in excess of £962: 2%

Reduced rate for married women and widows with a valid election certificate on earnings below upper earnings limit. 5.85%

Rates for men and women over state pensionable age: Nil

Class 2 Contributions for the self-employed

Weekly flat rate £3.00

Small earnings exception £6,365

Class 4 Contributions for the self-employed

On profits between £8,632 and £50,000: 9%

On profits in excess of £50,000 2%

Class 3 voluntary contributions - weekly rate £15.00

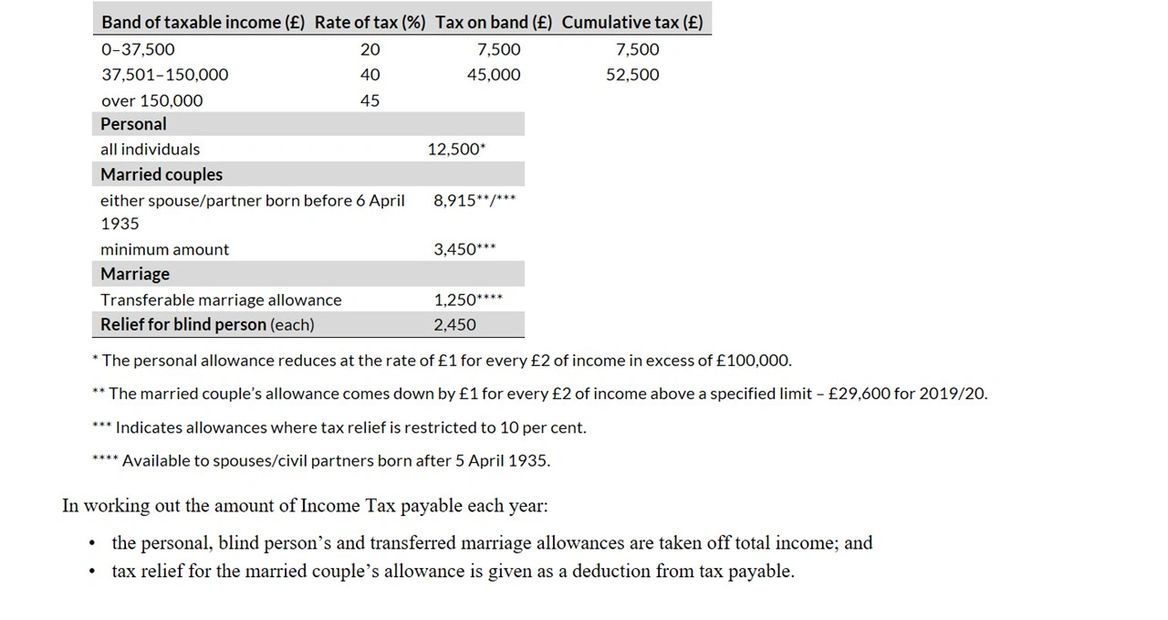

Tax Rates and Allowances

In UK, the tax or fiscal year runs from each 6 April to the following 5 April. The rates of tax for 2019/20 are shown in the view.

Copyright © 2020 Ace Allizon Solutions Ltd - All Rights Reserved. Registered in United Kingdom

Powered by GoDaddy Website Builder